After years of persistent campaigning from the Jersey Consumer Council, applying for a wider range of credit cards may soon be an option again for Islanders.

The government has backed an amendment to change the way information is shared with UK credit reference agencies, following nearly five years of campaigning and pressure for action from the Jersey Consumer Council.

States Members have approved Chief Minister Lyndon Farnham’s amendments to the Register of Names and Addresses (Jersey) Law, to create a centralised database to allow credit reference agencies to carry out checks on residents who apply for certain financial services. This will allow limited personal data to be shared with these companies, as ring-fencing laws require finance firms to keep their British and offshore operations separate.

This follows the States vote in 2023 when Members unanimously supported a proposal to allow credit reference agencies the access to the personal data that they need for Islanders to have access again to all the usual credit cards.

For a number of years, Islanders have experienced issues in applying for credit cards.

Prior to that, we had spent three years fighting on behalf of Islanders, after hundreds told us they had either had credit cards withdrawn or were unable to access credit cards.

Since then, we’ve been meeting government representatives regularly for updates, but during this time we have continued to hear from consumers in Jersey who’ve faced more and more credit card issues.

The amendment will allow government-held names and addresses to be supplied to credit reference agencies for clearly defined purposes. These include supporting credit checks by banks and lenders and, critically, enabling law enforcement access where required.

The amendment aims to “help create the conditions necessary for additional credit services to be provided to Islanders, including the provision of credit card services” and names and addresses would only be provided to credit reference agencies for credit-checking purposes.

Two of the three major agencies consulted have already indicated they are content that the amendment would remove key obstacles to offering credit cards in Jersey, according to the report.

Under the plans, data relating to under-18s would be automatically excluded, and adults will be given a one-month notice period to opt out of having their details shared. An opt-out would remain available even after that initial window and the Office of the Information Commissioner has indicated the proposals are satisfactory from a data protection standpoint.

The law change is described as a “necessary and proportionate” step to bring Jersey into line with the UK and provide credit card services to Islanders.

During the States Assembly, Treasury and Resources Minister, Elaine Miller said: “It should help finally resolve one of our biggest issues around credit card availability in Jersey.”

Jersey Consumer Council chair Carl Walker said: “This will make the process simpler and we hope that some credit card companies will become available to Islanders again.

“The changes will allow credit card companies to check that Islanders are a real person who actually lives here, and hopefully it will make that process simpler.

“Whether it’s too late and some of those credit card companies will say they now can’t be bothered to reopen to Jersey, we’re not sure, but we’re keeping our fingers crossed.”

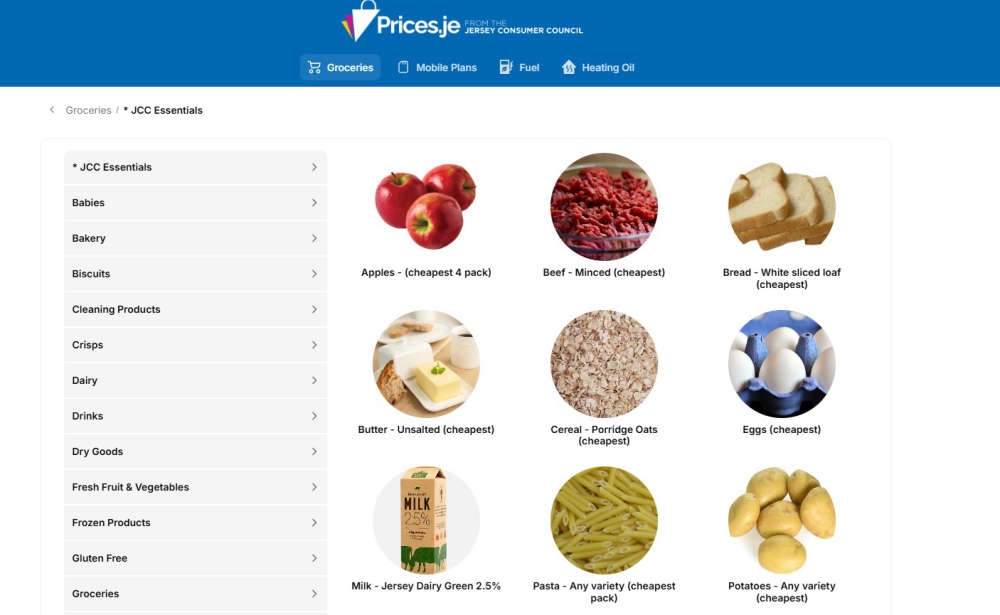

Remember: It pays to shop around

Remember: It pays to shop around

Watch out for Valentine’s romance scams

Watch out for Valentine’s romance scams

Mobile phone bills: why it pays to compare before you commit

Mobile phone bills: why it pays to compare before you commit

Pensioner asks: “Why can’t I have an accurate quarterly meter reading?”

Pensioner asks: “Why can’t I have an accurate quarterly meter reading?”

Do I need a TV licence? Take our quiz

Do I need a TV licence? Take our quiz

How banks are helping you stay safe from scam calls and fraud

How banks are helping you stay safe from scam calls and fraud