Giving a voice to consumers in Jersey since 1995

We’re here to stand up for consumers.

We shine a light on issues, call out what’s not right, and give Islanders clear, up-to-date information so they can make smart choices.

2025 in numbers

Last year was one of our busiest yet:

- 16,000+ prices compared

- 560+ consumer issues investigated

- 200+ media appearances

Latest News

Keep up to date with the latest from the Jersey Consumer Council

-

Travel guidance for The Middle East

Travel guidance for The Middle EastThe Jersey Consumer Council extends its thoughts to all those affected by the recent events in the Middle East.

-

Shop smart this Easter: Compare before you buy

Shop smart this Easter: Compare before you buyWhen you next visit Prices.je, you’ll notice that we’ve added a new Easter section. Featuring Easter eggs, chocolate bunnies and hot cross buns, among other products, this seasonal section will help you to shop around for the best prices this Easter.

-

Keeping your home dry during wet weather days

Keeping your home dry during wet weather daysWe’ve had an unusually long spell of wet weather over the past few months, and with conditions this damp, many households are having to dry their laundry indoors. Here are some effective steps you can take to keep your home healthier during challenging weather.

-

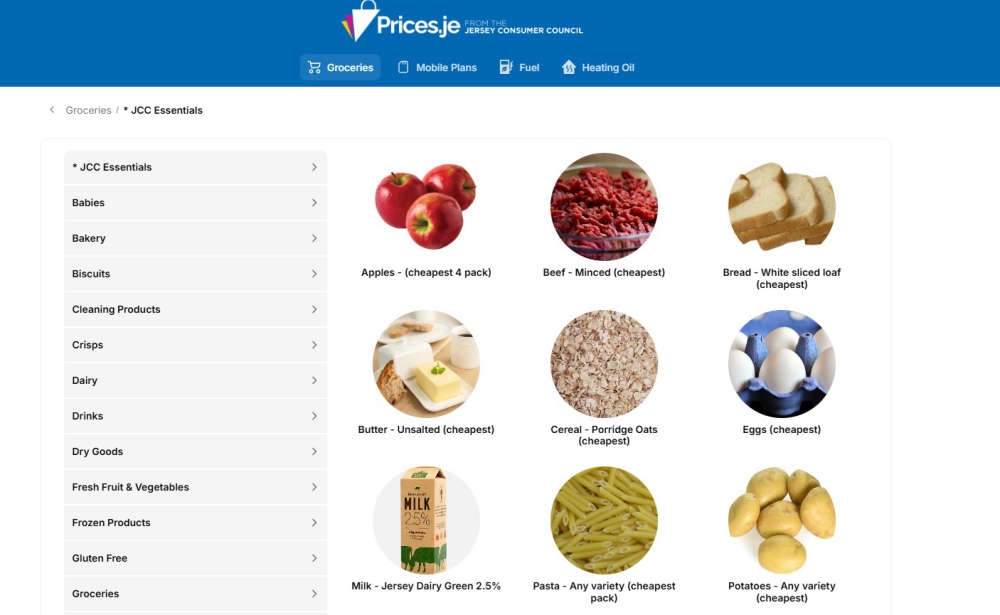

Remember: It pays to shop around

Remember: It pays to shop aroundHave you visited our price comparison website lately? At the Jersey Consumer Council, we know it pays to shop around, so we run Prices.je to empower consumers in Jersey to compare prices before deciding where to spend their money.

-

Watch out for Valentine’s romance scams

Watch out for Valentine’s romance scamsLooking for love this Valentine’s Day? Dating apps and social media can be great ways to meet people — but they’re also fertile ground for fraudsters. By building trust and then exploiting emotions, dating fraudsters aim to get money, personal details, or even to pull you into “investment” traps. Stay a step ahead with these clear checks and simple actions

-

Mobile phone bills: why it pays to compare before you commit

Mobile phone bills: why it pays to compare before you commitMobile phones are an essential part of everyday life for most Islanders, but many of us may be paying more than we need to for our monthly contracts. With a growing choice of providers and packages, the Jersey Consumer Council is reminding consumers that it’s worth taking the time to shop around and compare deals before signing up.