After more than two years of falling inflation, the latest figures from Statistics Jersey show that the annual rate of inflation has risen to 2.6% in the year to June, up from 2.3% in March.

This marks the first increase since December 2022 and signals renewed pressure on household budgets across the Island.

Our Chairman, Carl Walker is concerned about the ongoing strain on household finances.

“A fifth of Jersey families are struggling to meet their basic needs,” he said. “It continues to be a daily struggle for lots of people in Jersey, and where they are feeling that pinch the most is when they are buying their groceries.”

The situation in Jersey reflects broader trends seen in the UK, where food prices have risen by 5.2% over the past month compared to last year.

According to market researcher Worldpanel by Numerator, the average UK household is on course to spend £275 more on groceries this year unless shopping habits change.

Consumers are increasingly turning to supermarket own-brand products and preparing simpler meals to cut costs. And nearly seven in ten UK dinner plates now include fewer than six components—a sign of how rising prices are reshaping daily life.

Carl said that price increases in the UK often take time to filter through to Jersey, but that the signs are already worrying.

“We’ve recently seen UK prices increase by around five per cent, and this usually means prices here will rise again as we move into the autumn,” he said. “We’ve got more and more people in Jersey relying on food banks, and in supermarkets, people are following staff who are reducing items so they can grab them before anyone else.”

The latest figures suggest that the cost of living is rising faster for those least able to absorb it:

- Pensioner households: inflation rose to 3.8%

- Low-income households: inflation rose to 3.9%

What’s driving the RPI increase?

The rise in the Retail Prices Index (RPI) has been largely driven by:

- Leisure services (including holidays, entertainment, and sports): up 6.4%

- Food (shop-bought): up 4.1%

- Household services (school fees, phone bills): up 3.2%

- Fuel and light: up 6.3%

- Catering (eating out, takeaways): up 4.3%

While some categories such as housing, household goods, and leisure goods have seen slight price drops, these have not been enough to offset the broader upward trend.

Can the Government do more to support Islanders?

In an interview on BBC Radio Jersey, Chairman Carl Walker said: “Maybe now is the time for other agencies and potentially the Government to perhaps do more than they are doing at the moment to help.

In an interview on BBC Radio Jersey, Chairman Carl Walker said: “Maybe now is the time for other agencies and potentially the Government to perhaps do more than they are doing at the moment to help.

“The help given by Government at the moment is targeted towards those who are already in their system, but everybody is feeling the pinch at the moment, so is it time to have a look at what more could be done?

"We’ve seen them bring down prices of doctors’ fees, but is there more that could be done with grocery fees – for example taking GST off fruit and veg to encourage Islanders to eat healthy, fresh meals?”

What can consumers do?

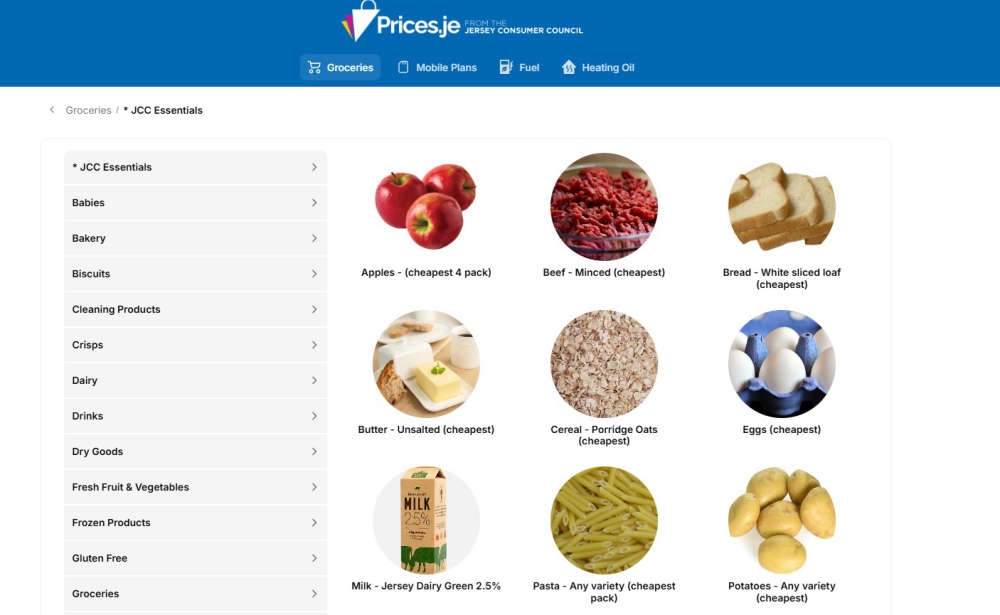

While acknowledging that not everyone can ‘shop around’ easily, the Council encourages Islanders to stay informed.

“Consumers are far more educated about this sort of thing than they were 20 years ago,” he said. “They can see prices rising in front of their eyes.

“We encourage consumers to look at Prices.je and see where the cheapest place is to buy certain items is. Work that into your everyday life—when you’re passing a shop, pop in for the cheapest items which are sold there.”

He added: “Consumers have a key role to play. If we keep buying the same thing regardless of price differences, supermarkets won’t lower their prices. Shopping around is important.”

The Jersey Consumer Council continues to monitor price trends. Visit Prices.je for the latest prices.

Travel guidance for The Middle East

Travel guidance for The Middle East

Keeping your home dry during wet weather days

Keeping your home dry during wet weather days

Remember: It pays to shop around

Remember: It pays to shop around

Watch out for Valentine’s romance scams

Watch out for Valentine’s romance scams

Mobile phone bills: why it pays to compare before you commit

Mobile phone bills: why it pays to compare before you commit

Pensioner asks: “Why can’t I have an accurate quarterly meter reading?”

Pensioner asks: “Why can’t I have an accurate quarterly meter reading?”