The quarterly Jersey Retail Prices Index (RPI) figures were published on 25 April by Statistics Jersey.

The latest report shows that prices overall in Jersey went up by 2.3% over the past 12 months up to the end of March, which is slightly less than the 2.5% increase seen in the year up to the end of December 2024.

This means that inflation is easing a bit, and it’s much lower than it was at this point a year ago, when it was running at 5.7%, which is good news.

The Retail Prices Index (RPI) is the main measure of inflation in Jersey.

It measures the average change in prices of goods and services purchased by households and is sometimes referred to as the 'cost of living'.

What’s driving the changes?

- The most significant price increases came from leisure activities — things like holidays, entertainment, and sports, which had the greatest impact.

- Household services (like internet and childcare) and heating and energy bills also saw noticeable rises. Meanwhile, housing costs (like mortgage payments) actually fell slightly, thanks to lower interest rates.

- Furniture, appliances, and home goods also got a little cheaper. Although tobacco prices are still climbing, they didn’t rise as sharply as they did late last year, which helped keep overall inflation lower.

- The report also discusses ‘underlying’ inflation rising by 3.4% — this is a special measure that strips out things like mortgage payments and taxes. Therefore, pensioners and low-income households faced similar price rises — about 3.3% to 3.4% over the year, showing that both demographics may still be struggling with general cost of living costs.

What has happened in the last three months?

- Between December 2024 and March 2025, prices overall went up by 1.4%.

- The biggest jumps were in tobacco and heating costs.

- Most other categories had smaller increases or stayed fairly stable.

How does this compare to the UK?

- Jersey’s inflation rate (2.3%) is lower than the UK’s (3.4%), meaning prices here are rising more slowly than across the water.

Changes to how inflation is measured:

- Fresh fruit and vegetables are no longer treated as ‘seasonal’, because they're available year-round.

- Used car prices are now based on Office for National Statistics figures rather than local Jersey prices. Statistics Jersey say this is more reliable than used car sales in the local market.

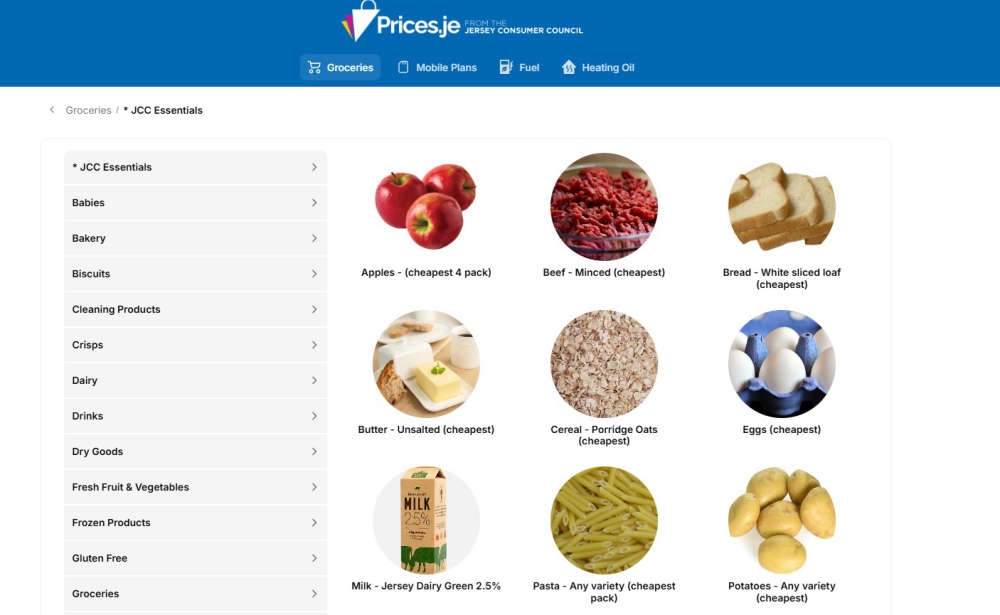

We will continue to monitor the cost of living and by visiting our price comparison site prices.je you can compare the prices of groceries, fuel and oil prices.

Travel guidance for The Middle East

Travel guidance for The Middle East

Keeping your home dry during wet weather days

Keeping your home dry during wet weather days

Remember: It pays to shop around

Remember: It pays to shop around

Watch out for Valentine’s romance scams

Watch out for Valentine’s romance scams

Mobile phone bills: why it pays to compare before you commit

Mobile phone bills: why it pays to compare before you commit

Pensioner asks: “Why can’t I have an accurate quarterly meter reading?”

Pensioner asks: “Why can’t I have an accurate quarterly meter reading?”