We're receiving a growing number of complaints involving builders and garden landscapers who are doubling or significantly increasing their final bills, far beyond what was initially quoted — with little recourse for affected consumers.

Some Islanders — including elderly and vulnerable clients — have reported being pressured into paying inflated invoices, often under threat of legal action. In some cases, when customers attempt to challenge the charges through the courts, these rogue traders simply dissolve their businesses and reopen under new names, avoiding accountability entirely.

Carl Walker, Chairman of the Jersey Consumer Council, described the practice as “morally bankrupt” and “a serious abuse of trust.”

“We are seeing a worrying trend of tradespeople exploiting gaps in Jersey’s consumer protection laws,” he said. “People are being overcharged and left with no clear route to justice. That’s not just unethical — it’s unacceptable.”

The problem lies partly in the legal distinction between quotes and estimates. Under UK consumer law, a quote is legally binding and, once accepted, it should not be changed without agreement from the customer. An estimate, by contrast, is only a rough guide and may vary. The UK’s Consumer Rights Act 2015 also requires work to be carried out with reasonable care and at a fair price, if none is agreed upfront.

According to information on gov.je: ‘An estimate is usually just an informed guess, however a quotation is a fixed price which is legally binding.

Don’t assume that all traders provide free quotations. Ask before you invite them to your home. Also check any terms and conditions that may accompany a quotation before you accept.'

In Jersey, however, consumer protection law is less robust. There is no direct equivalent to the Consumer Rights Act, and the enforcement of contracts relies heavily on civil court proceedings, which many Islanders are reluctant or unable to pursue, so the advice issued on gov.je isn’t as clear as it could be as it seems any legal challenge will involve you spending on lawyers and court fees.

“These builders know that most clients won’t take legal action, especially if they’re elderly or unsure of their rights,” said Mr Walker. “And when someone does fight back, some of these traders simply fold the company and start again with a new name. That has to stop.”

One consumer who’s contacted the Council, who requested to remain anonymous, decided to take on one Jersey-based building firm who added more than 50% to the amount they had originally quoted for an extension. The firm submitted a bill for over £300,000, having originally quoted £196,000. After standing his ground, the building firm issued him with a legal letter, threatening to sue him, so he counter-sued for the damage and poor workmanship, spending more than £9,000 on legal fees.

The consumer has been left with unfinished building works and a substantial repair bill. The issue is further compounded by the fact that if the amounts involved are greater than £30,000 they cannot go to independent arbitration leaving the expensive legal route as the only way of settling the issue due to a complete lack of consumer protection.

The professional project manager told us that they felt the threat of legal action was being used as a weapon to extort money from consumers due to the limit of £30,000 removing the arbitration route.

Another consumer we’ve heard from was originally quoted £192,000, but the builder demanded a final cost of £263,000, even though the building work had not been signed off by Building Control. The consumer has been left with an estimated repair and restoration bill to meet the approved bylaws and designs of more than £180,000.

Until there is more clarity on the issue, Islanders are urged to get all quotes in writing, request detailed breakdowns of charges, and avoid paying large sums up front. It is also worth checking-in with your builder/contractor regularly to check the works and costs are still on budget.

“It does not take a genius to work out that this is very wrong and needs stamping out immediately before any more Islanders are essentially ripped off,” added Mr Walker.

For advice, or to report an issue, Islanders can contact us on contact@consumercouncil.je.

Travel guidance for The Middle East

Travel guidance for The Middle East

Keeping your home dry during wet weather days

Keeping your home dry during wet weather days

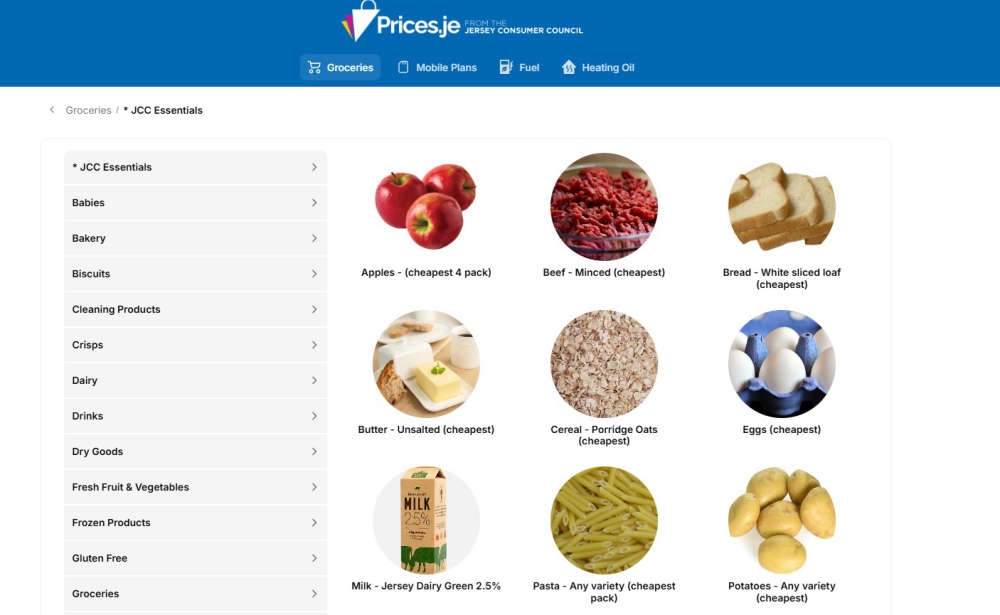

Remember: It pays to shop around

Remember: It pays to shop around

Watch out for Valentine’s romance scams

Watch out for Valentine’s romance scams

Mobile phone bills: why it pays to compare before you commit

Mobile phone bills: why it pays to compare before you commit

Pensioner asks: “Why can’t I have an accurate quarterly meter reading?”

Pensioner asks: “Why can’t I have an accurate quarterly meter reading?”