Giving a voice to consumers in Jersey since 1995

We’re here to stand up for consumers.

We shine a light on issues, call out what’s not right, and give Islanders clear, up-to-date information so they can make smart choices.

2024 in numbers

Last year was one of our busiest yet:

- 14,000+ prices compared

- 560+ consumer issues investigated

- 110 media appearances

Latest News

Keep up to date with the latest from the Jersey Consumer Council

-

Motorists urged to check car finance deals – download our template letters

Motorists urged to check car finance deals – download our template lettersTemplate letters enabling Jersey motorists to investigate potential commission issues in their car finance agreements are now available to download from our website, allowing consumers to take the first formal step in establishing how their finance was arranged.

-

Consumers warned of temporary mail delays following ferry service withdrawal

Consumers warned of temporary mail delays following ferry service withdrawalIslanders are being advised to expect temporary delays to mail services as a result of ferry operator DFDS withdrawing its Tuesday evening sailing. As a result of the change, all mail arriving in or leaving Jersey on a Tuesday will be delayed by up to 24 hours.

-

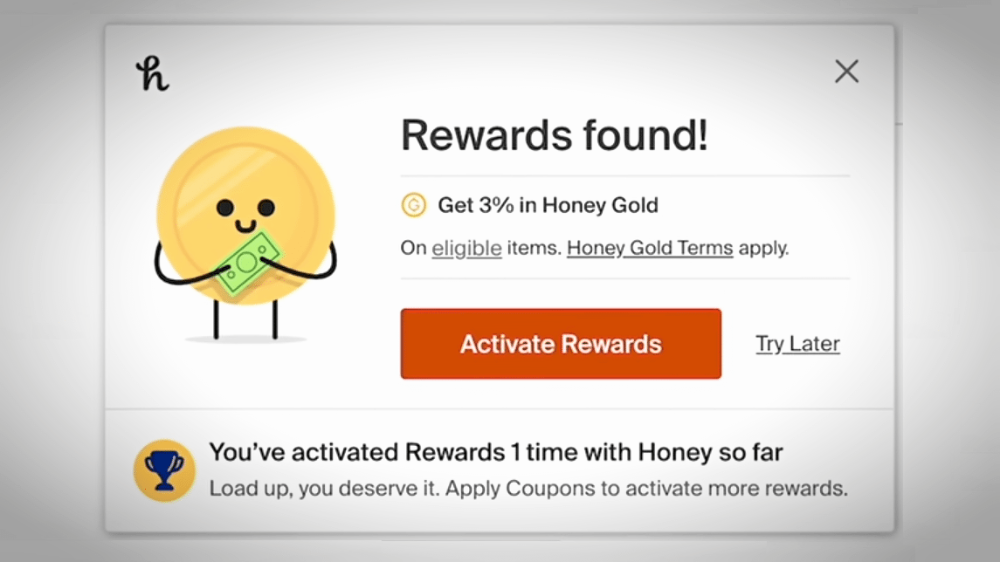

The hidden cost of voucher-sharing apps

The hidden cost of voucher-sharing appsMillions of consumers have turned away from PayPal’s popular voucher-sharing service, Honey, after it was alleged to have exploited users and deceived advertisers.

-

Jersey Post increase collections from Amazon depots to resolve recent issues

Jersey Post increase collections from Amazon depots to resolve recent issuesJersey Post has increased the number of collections from Amazon depots this week, to help get online orders to the Islander faster. In recent weeks, many consumers have contacted us about the issues they’ve been experiencing with Amazon orders since before Christmas.

-

January planning: Think ahead and save

January planning: Think ahead and saveJanuary isn’t just about returns, it’s also a great time to plan for the rest of the year and make savvy purchases early.

-

Make your consumer rights your New Year’s resolution

Make your consumer rights your New Year’s resolutionThe New Year is here – and no doubt many Islanders will be thinking about what to do with any unwanted or unsuitable Christmas presents they’ve received. And even if you’re not, you may receive a Birthday present, or other gift, over the coming year which isn’t quite right.